Credit is complicated, and we love talking about it so here is a quick-ish overview.

The Parties

Credit Reporting Agencies aka Credit Bureaus: There are 3 major credit bureaus: Equifax, Experian, and Trans Union. They are private companies that compile your financial information for companies who wish to extend you credit.

Subscribers aka Data Furnisher: These are the companies reporting your account information to the credit bureaus. They report information like payment history, account balance, date of last activity, etc. Credit reporting is voluntary, so how often this info is reported, and which credit bureau this info is reported to varies by company. These variations are why your credit scores differ between credit bureaus.

Credit Reports: Are a tool to help companies decide whether to give/extend you credit. You have 3 credit reports, 1 of each credit bureau. There are many types of credit reports, and all have different formats, but they generally contain 5 sections of information:

- Personal Information: this section includes your name, social security number, date of birth, address, and current employer.

- Inquiry History: this section show where you have applied for credit in the last 24 months aka Hard Pulls (e.g. car loans, mortgages, and credit cards.) It also shows Soft Pulls which don’t hurt your credit score- these are generally Promotional (like those seemingly random credit card offers you get in the mail) or Account Reviews (companies you already have a financial relationship with who periodically check your credit – aka random credit limit increases or decreases, also debt collectors).

- Account History: this section shows every company you currently have credit accounts with (and accounts that have closed in the last 7 years) like credit cards, car loans, mortgages, student loans, and collection accounts.

- Public Records: this sections includes information about judgments, bankruptcies, and tax liens. Just FYI, criminal records are not reported in credit reports.

- Credit Scores: not every credit report includes a credit score, weird right? But see below for more info on credit scores.

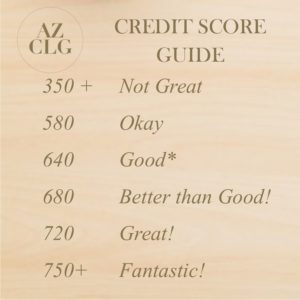

Credit Scores

Credit Scores are a numerical representation of your credit worthiness aka how likely you are to make good on your financial obligations. You have 3 credit scores, 1 for each credit bureau, and these scores change regularly because subscribers report information at different times. This is why bad credit today can be good credit in the future.

What Is My Credit Score?

Don’t be afraid to check your credit because we can help you improve it. You can check for FREE at:

It does not hurt your credit to go through these sites, it does not count as an “inquiry.” They are accurate, up to date, and best of all free.